Большой передел мира

266,921,956

522,121

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

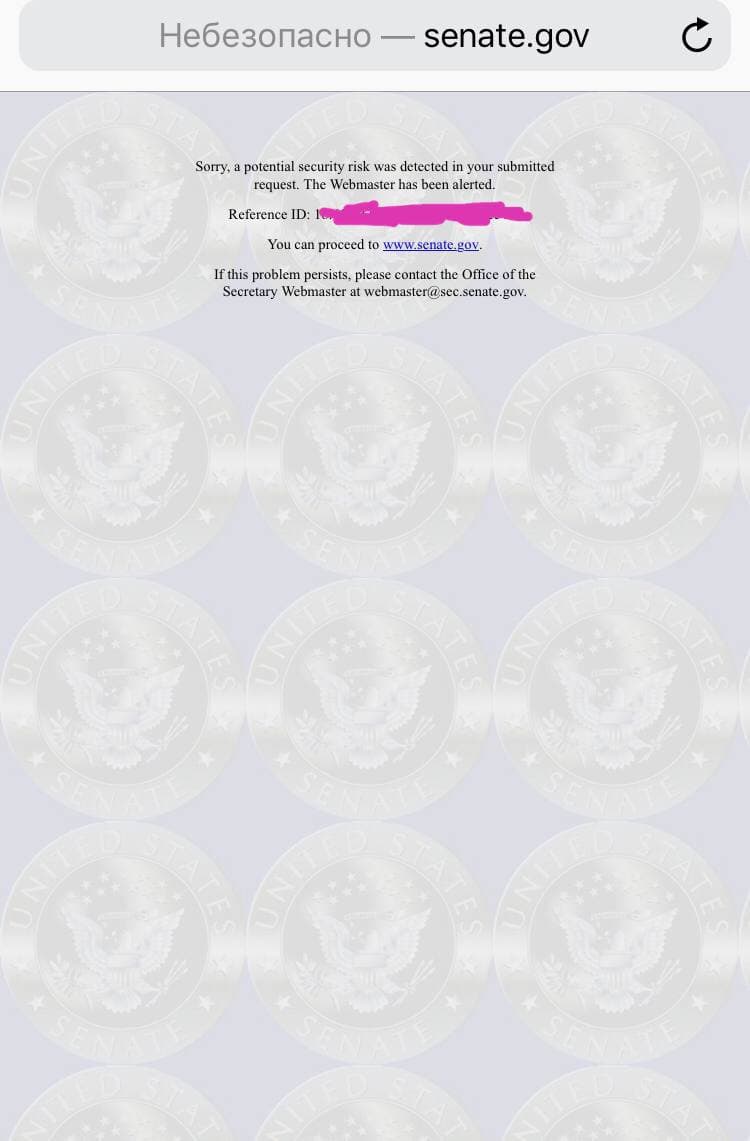

Не успели на сайте Сената выложить рассекреченные Трампом документы, как он явно подвис

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

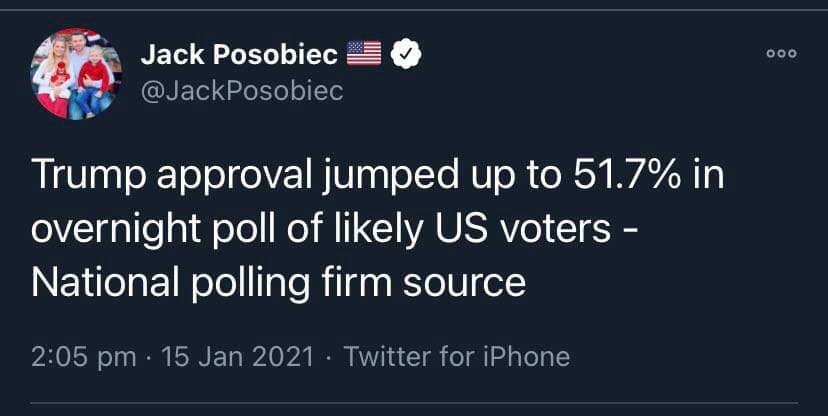

Согласно последнему соцопросу среди потенциальных избирателей, процент одобрения Трампа подскочил до 51,7%

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Цитата: DeC от 16.01.2021 00:06:42Не успели на сайте Сената выложить рассекреченные Трампом документы, как он явно подвисСкрытый текст

Судя по отдельным намекам, в оставшиеся дни президентства Трампа нас ждет продолжение процедуры рассекречивания документов

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: -87.84

Регистрация: 10.06.2014

Сообщений: 851

Читатели: 1

Регистрация: 10.06.2014

Сообщений: 851

Читатели: 1

Цитата: ДмитрийА от 15.01.2021 23:59:20Хорошо, не 99%, ну 95% вас устроит?

Да пусть хоть 99,9%. Если Вам уж так сильно хочется в процентах. Но даже пусть оставшиеся те 0,1%, какие были мной перечислены выше - КРУЧЕ И МАССШТАБНЕЕ ЛЮБЫХ ИНЫХ ОПЕРАЦИЙ всех остальных ДИВЕРСАНТОВ во время ВОВ. Поэтому даже тот же Черчилль отзывался о этих операциях как о «великом дерзании», а о их реализаторе как о «самым опасным человеком в Европе».

Карма: +40,887.80

Регистрация: 15.03.2012

Сообщений: 25,265

Читатели: 22

Регистрация: 15.03.2012

Сообщений: 25,265

Читатели: 22

Федеральные прокуроры США заявили, что некоторые из тех, кто штурмовал Капитолий в Вашингтоне 6 января, намеревались «захватить и убить избранных должностных лиц». Об этом сообщает в пятницу, 15 января, CNN.

По данным телеканала, прокуроры написали в судебном протоколе, что «бунтовщики захватили Капитолий с целью захватить и убить избранных должностных лиц». Эта информация была включена в документ о задержании Джейкоба Ченсли, который призывал людей атаковать Капитолий, используя мегафон. Отмечается, что Ченсли необычно нарядился на протест — его отличал головной убор, раскраска лица и шестифутовое копье.

https://iz.ru/111226…um=desktop

По данным телеканала, прокуроры написали в судебном протоколе, что «бунтовщики захватили Капитолий с целью захватить и убить избранных должностных лиц». Эта информация была включена в документ о задержании Джейкоба Ченсли, который призывал людей атаковать Капитолий, используя мегафон. Отмечается, что Ченсли необычно нарядился на протест — его отличал головной убор, раскраска лица и шестифутовое копье.

Скрытый текст

https://iz.ru/111226…um=desktop

Роса рассветная, светлее светлого,

А в ней живет поверье диких трав,

У века каждого на зверя страшного,

Найдется свой, однажды, Волкодав

А в ней живет поверье диких трав,

У века каждого на зверя страшного,

Найдется свой, однажды, Волкодав

Петропавловск-Камчатский

44 года

Карма: +3,667.96

Регистрация: 17.08.2008

Сообщений: 12,424

Читатели: 8

Регистрация: 17.08.2008

Сообщений: 12,424

Читатели: 8

Цитата: Densoider от 15.01.2021 22:04:49Хуавэй, Ксяоми.

На месте Самсунга я бы начал напрягаться. Нету ли у них там где антисемитизьму тащемто, например?

Походу Штаты усиленно обрубают любые концы от любых смартфонов, загоняя народ ТОЛЬКО в Айфоны.

На фоне их цифрового безумия думаю не надо обьяснять что дальше будет.

Welcome to GoogLag!

Штаты усиленно обрубают Китайские смартфоны - что в рамках вялотекущей торговой войны - скорее нормально, чем нет.

Зачем Самсунгу напрягаться? С ЮК и Японией у США торговых войн нету, да и санкции в отношении Китая они если что поддержат.

Кроме того в ЮК есть военная база США.

З.Ы, Ну и кроме того в отличии от сборочных производств Китая - в ЮК расположены как раз физические производства - их санкционировать и заменить гораздо сложнее чем Китайские "заводы".

Рожденный ползать - не мешайся на взлетной полосе.

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Макрон действительно написал письмо Эрдогану, подтвердили РИА Новости в Елисейском дворце и напомнили, что французский президент никогда не отказывался от диалога с турецким коллегой.

"Нужны реальные шаги в поддержку его (Эрдогана) слов... Речь идёт о том, чтобы получить конкретные результаты. Мяч сейчас на стороне президента Турции", - отметила представительница пресс-службы.

"Нужны реальные шаги в поддержку его (Эрдогана) слов... Речь идёт о том, чтобы получить конкретные результаты. Мяч сейчас на стороне президента Турции", - отметила представительница пресс-службы.

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Ещё одним элементом подготовки Вашингтона к инаугурации Байдена (помимо заборов с колючей проволокой и военных) стало обновление надписи «Black Lives Matter» длиной в два квартала в самом центре города.

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Национальная стрелковая ассоциация подала на банкротство и заявила о переезде из Нью-Йорка в Техас

Отредактировано: DeC - 16 янв 2021 01:44:59

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

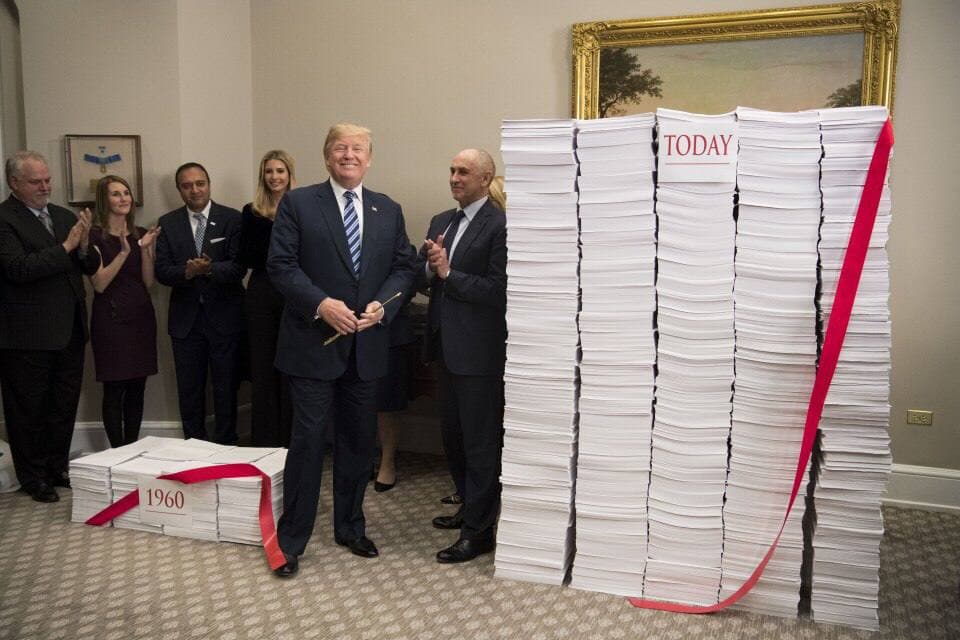

Трамп объявил о скорой публикации всех документов по “Рашагейту” и “Обамагейту” - скандалу со шпионажем за кампанией Трампа в попытке уличить его в связях с Россией в 2016 году. Они должны быть полностью рассекречены в последние дни президентства Трампа.

Ещё год назад завершилось расследование генерального инспектора ФБР Майкла Горовитца, который сообщил подробности слежки за Трампом. А прямо сейчас продолжается расследование Джона Дарема об истоках “Рашагейта” - он недавно получил статус спецпрокурора США.

Проблемы транспарентности: пока Трамп рассекречивает документы, либеральные фонды под крылом у BLM, наоборот, отказываются предоставлять любые сведения о своей работе. Один из этих фондов, поддержанных Камалой Харрис, уже “прославился” тем, что помог выйти из тюрьмы педофилу.

Федеральные прокуроры арестовали активиста BLM, который участвовал в штурме Капитолия. Либеральная пресса об этом молчит - ведь нельзя же ломать удобный нарратив о том, что в здание Конгресса прорвались одни лишь “коварные трамписты”.

Байден обещает “объявить войну” Национальной стрелковой ассоциации и её победить. Готовясь к этой войне, Америка стремительно вооружается - в 2020 году было получено 40 млн лицензий на владение огнестрелом, большинство из них выдано тем, кто впервые взял в руки оружие.

В первый год президентства Байден попробует протащить через Конгресс запрет на полуавтоматические винтовки. Сейчас на руках у американцев больше 20 млн карабинов AR-15 - и без кампании массовых обысков их формальный запрет вряд ли удастся провести в жизнь.

Но в ситуации общего “закручивания гаек” в США стоит ожидать и показательных процессов в отношении тех, кто не захочет расставаться со своими винтовками, и тотального засекречивания работы “глубинного государства”, для которого победа Байдена стала манной небесной.

//Малек Дудаков

Ещё год назад завершилось расследование генерального инспектора ФБР Майкла Горовитца, который сообщил подробности слежки за Трампом. А прямо сейчас продолжается расследование Джона Дарема об истоках “Рашагейта” - он недавно получил статус спецпрокурора США.

Проблемы транспарентности: пока Трамп рассекречивает документы, либеральные фонды под крылом у BLM, наоборот, отказываются предоставлять любые сведения о своей работе. Один из этих фондов, поддержанных Камалой Харрис, уже “прославился” тем, что помог выйти из тюрьмы педофилу.

Федеральные прокуроры арестовали активиста BLM, который участвовал в штурме Капитолия. Либеральная пресса об этом молчит - ведь нельзя же ломать удобный нарратив о том, что в здание Конгресса прорвались одни лишь “коварные трамписты”.

Байден обещает “объявить войну” Национальной стрелковой ассоциации и её победить. Готовясь к этой войне, Америка стремительно вооружается - в 2020 году было получено 40 млн лицензий на владение огнестрелом, большинство из них выдано тем, кто впервые взял в руки оружие.

В первый год президентства Байден попробует протащить через Конгресс запрет на полуавтоматические винтовки. Сейчас на руках у американцев больше 20 млн карабинов AR-15 - и без кампании массовых обысков их формальный запрет вряд ли удастся провести в жизнь.

Но в ситуации общего “закручивания гаек” в США стоит ожидать и показательных процессов в отношении тех, кто не захочет расставаться со своими винтовками, и тотального засекречивания работы “глубинного государства”, для которого победа Байдена стала манной небесной.

//Малек Дудаков

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

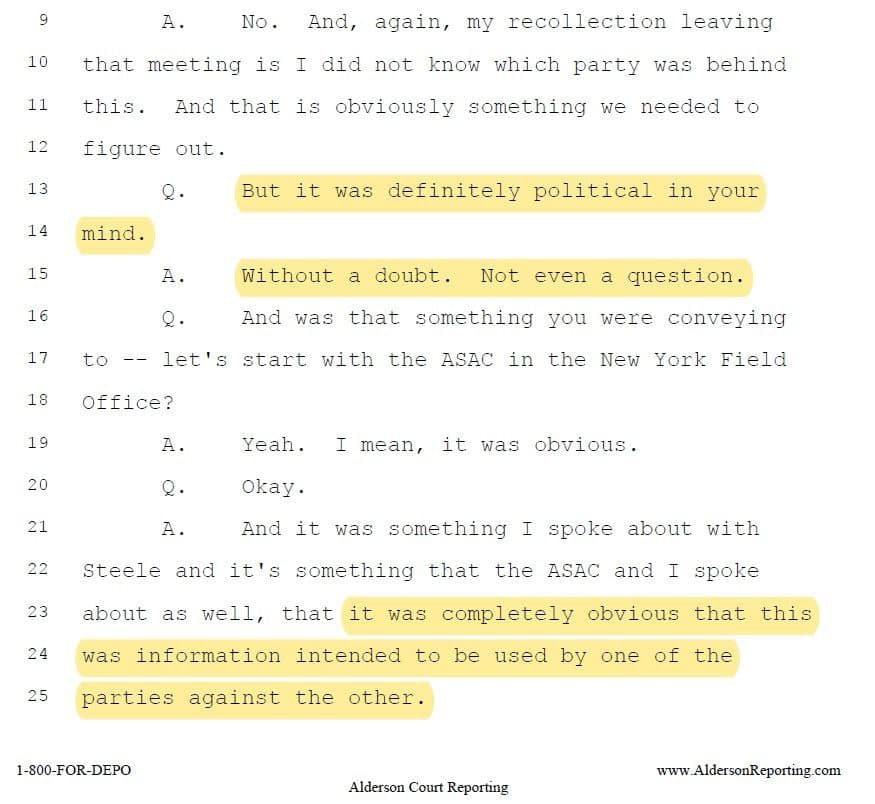

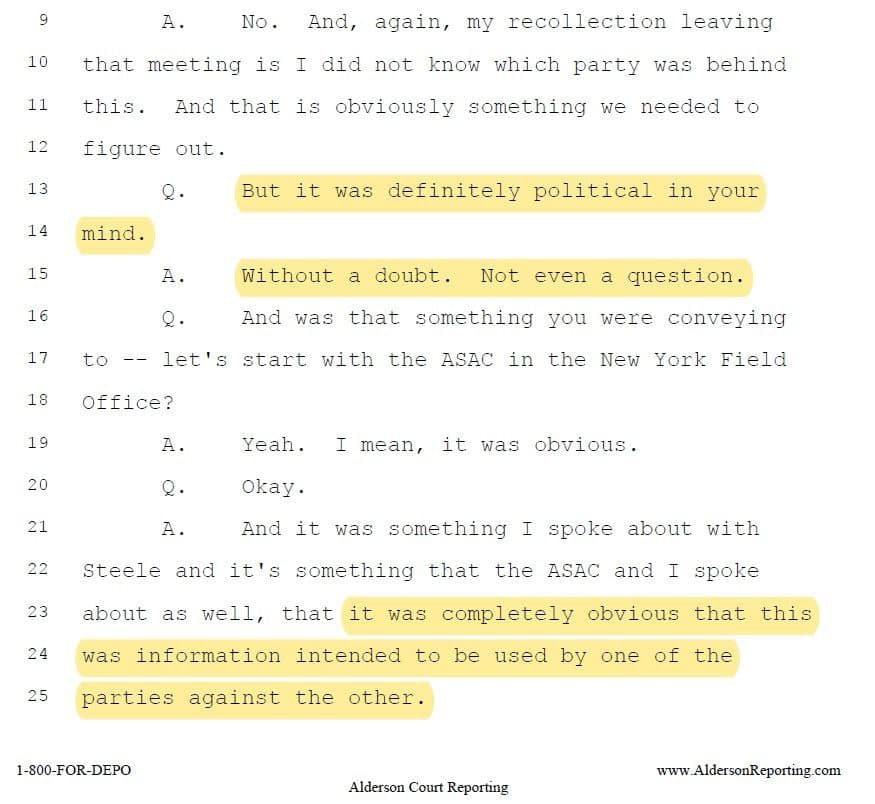

Рассекреченные Трампом документы подтверждают, что "российское вмешательство" в выборы в США было сфабриковано по политическим мотивам.

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

Карма: +420,889.94

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

Регистрация: 19.01.2009

Сообщений: 281,590

Читатели: 55

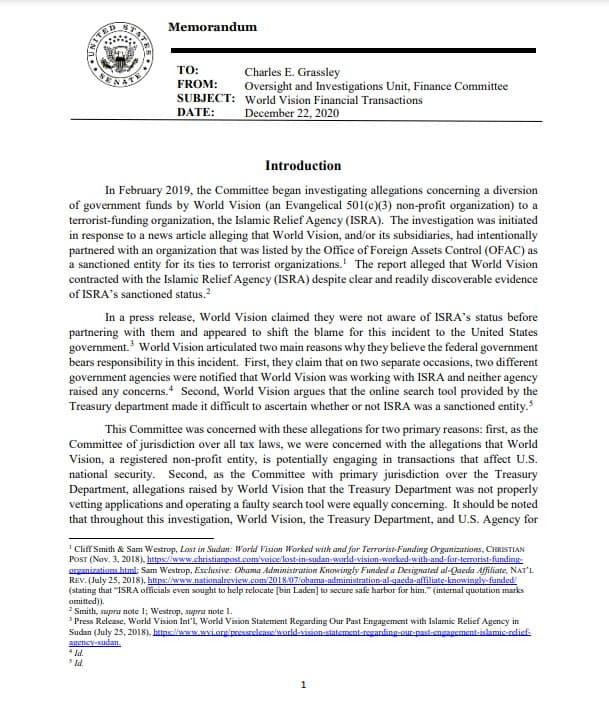

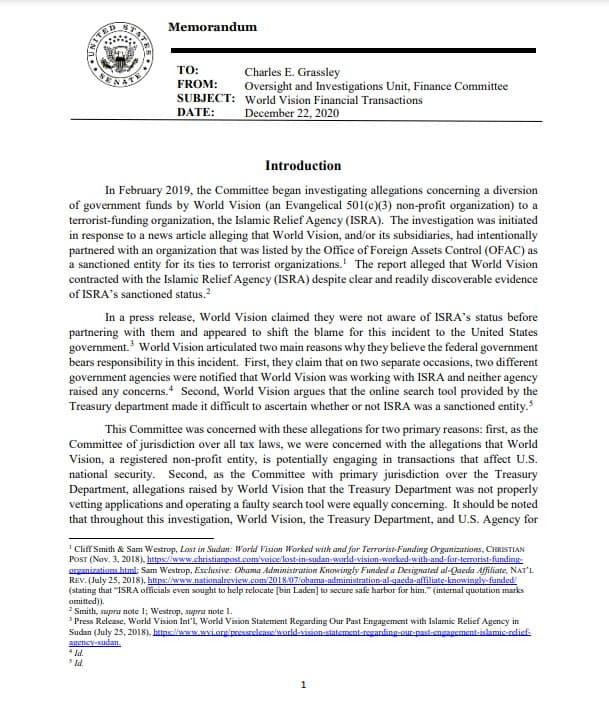

В Сети появился меморандум, согласно которому администрация Обамы сознательно разрешила финансирование террористической группировки Аль-Каида.

Скрытый текст

Язык ненависти оказывает сдерживающий эффект на демократический дискурс в онлайн-среде. (c) Еврокомиссия

67 лет

Карма: +33,857.97

Регистрация: 04.12.2011

Сообщений: 10,620

Читатели: 23

Регистрация: 04.12.2011

Сообщений: 10,620

Читатели: 23

Мессенджер WhatsApp отложил сроки введения новой политики, в соответствии с которой пользователи должны делиться данными с социальной сетью Facebook, сообщила администрация мессенджера.

«Мы слышали от очень многих людей о том, какое замешательство произошло в связи с недавним обновлением. Появилось много дезинформации, которая создала беспокойство, и мы хотим помочь всем понять наши принципы и [существующие] факты», – приводит текст сообщения администрации мессенджера ТАСС.

Как утверждают представители WhatsApp, сервис «всегда будет защищать персональные диалоги двусторонним шифрованием, так что ни WhatsApp ни Facebook не смогут видеть эти сообщения». В заявлении подчеркивается, что в связи с планируемым введением новых правил эти принципы не изменятся. В то же время администрация соцсети решила отложить дату принятия новой политики, чтобы разъяснить пользователям, в чем она заключается.

«Мы откладываем дату, когда пользователей попросят изучить и принять условия. Ни один аккаунт не будет заблокирован или удален 8 февраля. Мы также собираемся сделать больше, чтобы развеять дезинформацию по поводу личных данных и безопасности в WhatsApp», – указано в заявлении. В качестве крайнего срока теперь названа дата 15 мая.

Ранее WhatsApp обновил пользовательское соглашение, включив в него пункт о передаче личных данных корпорации Facebook. В частности, компания получит сведения о номерах телефонов, транзакциях и IP-адресах пользователей. После этого основатель мессенджера Telegram Павел Дуров выразил мнение, что новая политика WhatsApp привела к бегству пользователей в Telegram. Так, после обновления пользовательского соглашения от принадлежащего Facebook мессенджера отказалась администрация президента Турции. Кроме того, из WhatsApp в Telegram ушла глава ЦИК Элла Памфилова.

Напомним, создатель мессенджера Telegram Павел Дуров неоднократно предупреждал владельцев смартфонов об опасности использования приложения WhatsApp, призывая пользователей удалить со своих устройств принадлежащий Facebook мессенджер из-за обнаруженных в нем многочисленных уязвимостей в сфере безопасности.

Источник

А ведь веры им всё равно уже не будет. Сдох бобик.

«Мы слышали от очень многих людей о том, какое замешательство произошло в связи с недавним обновлением. Появилось много дезинформации, которая создала беспокойство, и мы хотим помочь всем понять наши принципы и [существующие] факты», – приводит текст сообщения администрации мессенджера ТАСС.

Как утверждают представители WhatsApp, сервис «всегда будет защищать персональные диалоги двусторонним шифрованием, так что ни WhatsApp ни Facebook не смогут видеть эти сообщения». В заявлении подчеркивается, что в связи с планируемым введением новых правил эти принципы не изменятся. В то же время администрация соцсети решила отложить дату принятия новой политики, чтобы разъяснить пользователям, в чем она заключается.

«Мы откладываем дату, когда пользователей попросят изучить и принять условия. Ни один аккаунт не будет заблокирован или удален 8 февраля. Мы также собираемся сделать больше, чтобы развеять дезинформацию по поводу личных данных и безопасности в WhatsApp», – указано в заявлении. В качестве крайнего срока теперь названа дата 15 мая.

Ранее WhatsApp обновил пользовательское соглашение, включив в него пункт о передаче личных данных корпорации Facebook. В частности, компания получит сведения о номерах телефонов, транзакциях и IP-адресах пользователей. После этого основатель мессенджера Telegram Павел Дуров выразил мнение, что новая политика WhatsApp привела к бегству пользователей в Telegram. Так, после обновления пользовательского соглашения от принадлежащего Facebook мессенджера отказалась администрация президента Турции. Кроме того, из WhatsApp в Telegram ушла глава ЦИК Элла Памфилова.

Напомним, создатель мессенджера Telegram Павел Дуров неоднократно предупреждал владельцев смартфонов об опасности использования приложения WhatsApp, призывая пользователей удалить со своих устройств принадлежащий Facebook мессенджер из-за обнаруженных в нем многочисленных уязвимостей в сфере безопасности.

Источник

А ведь веры им всё равно уже не будет. Сдох бобик.

Можно подвести лошадь к воде, но нельзя заставить ее напиться

город-герой Москва

Карма: +5,296.43

Регистрация: 12.06.2015

Сообщений: 4,902

Читатели: 0

Аккаунт заблокирован

Регистрация: 12.06.2015

Сообщений: 4,902

Читатели: 0

Аккаунт заблокирован

Цитата: ВТА от 07.12.2020 21:28:48Новейший британский авианосец затопило из-за неисправности системы пожаротушения

Новые корабли ВМС США оказались тихоходными и бракованными

F-35: Американский хайтек окончательно сел в лужу

Отредактировано: ВТА - 16 янв 2021 03:59:22

У России нет друзей, кроме армии, флота и Русской Православной Церкви

Лауреат Нобелевской премии академик Ж.И. Алфёров: «У меня очень простое и доброе отношение к РПЦ», потому что «Православная церковь отстаивает единство славян».

Лауреат Нобелевской премии академик Ж.И. Алфёров: «У меня очень простое и доброе отношение к РПЦ», потому что «Православная церковь отстаивает единство славян».

Челябинск

78 лет

Карма: +1,844.37

Регистрация: 05.10.2007

Сообщений: 2,271

Читатели: 1

Регистрация: 05.10.2007

Сообщений: 2,271

Читатели: 1

ЦитатаМария Захарова отметила, что досмотр был произведен якобы в рамках операции ЕС "Ирини". При этом российской стороне многое остается непонятным. Москва продолжит добиваться исчерпывающих разъяснений по поводу случившегося.

Об инциденте в Средиземном море рассказала владелец судна "Адлер". По ее словам, с ними связался греческий военный корабль и попросил предоставить информацию о перевозимом грузе. После солдаты высадились на судно и провели его досмотр. Они объяснили, что таким образом проверяют осуществление незаконных поставок оружия в Ливию.

Ну так надо российским военным досмотреть какое-нибудь греческое судно в Средиземном море и проверить "осуществление незаконных поставок оружия" в Сирию. И операцию назвать "Гетера".

Карма: +2,222.01

Регистрация: 29.10.2009

Сообщений: 4,716

Читатели: 101

Регистрация: 29.10.2009

Сообщений: 4,716

Читатели: 101

Цитата: Bugi от 15.01.2021 10:47:53Подельников Оруэлла зачистили уже при СССР. Это в конце двадцатых - в тридцатые произошло. Сами знаете при ком.

Никто в Европе фабианцев зачищать не будет. Они вообще в Англии и являются ядром лейбористской партии. В Европе своих "социалистов" хоть отбавляй.

На мой гипотетический взгляд, чем бы сейчас на закончились события в штатах, следующим этапом там будет жёсткое приведение всех "свободномыслящих" к строгой узде. "Политику партии" одобрять нужно будет безоговорочное и искренне. То, что при этом будет широко декларироваться "свобода мнений" не должно сбивать с толку, ибо эта свобода будет из разряда: "розовое или голубое платьице мы наденем нашей доченьке". В этом и состоит смысл реальных "министерств правды" - в голове обывателя должна быть чёткая грань определяющая, что ему нужно всецело одобрять, а в чём он может чуть-чуть повыкобениваться. В принципе, на Западе для такого всё уже давно созрело.

Вслед за Штатами этим же самым займётся Европа. Вынуждена будет заняться, ибо если она этого не сделает, то леваки всех мастей и разновидностей её очень скоро угробят.

Буги! "Социализмов", как это известно на исторической практике -известна целая огромная куча. И - как явление - Фабианство изначально да, родилось в Британии, с базовой Идеей "медленного, последовательного перехода к социализму" с практикой "социализации" в тех элементах, где это экономически и политически оправдано. Естественно - изначально фабианство ориентировалось на рабочие движения - ибо в те годы-рабочие были доминирующим классом, в первую очередь - в Британии. Уже тот же самый Богданов допетрил, что под термином "социализм" скрывается целый пучок всякого разного -и вот тогда им и был инициирован более чем пятидесятилетний дискурс о "вариантах социального бытия". Я писал о "литературных последовательностях" этих самых моделей - кратко, в маленькой серии заметок "Ядерные Миры Герберта Уэллса". Собственно - в конце концов, в момент примерно соответствующий изданию работ Ефремова - фабианство нумер один - закончилось... и началось нью-фабианство, отличающееся от первого тем, что главной движущей и активной средой бытия в Социумах явилась та их часть, которую мы (вполне справедливо, кстати), называем "толпой пОпуасов". То есть -не смотря на "смену полярности" изначальных установок - проблема "социализации" - истинная Проблема, а не фейк догматиков "Богоизбранности" - сохранилась.

Да - "подельников Оруэлла" - зачистили, но "базис Фабианства" -остался (я имею ввиду именно те годы) - но зачищали их отнюдь не пресловутые "сталинисты", а как раз те, кто является фанатами "богоизбранного бытия" - впрочем, они зачищали распостранителей любых моделей, не соответствующей их базовым догмам. А вот именно те, кто (по крайней мере из России) - всю эту "инвариантную шелуху" фабианства - откинули, выбрав из нее рациональную часть - и, в частности, строили таки идеологические модели, которые приемлемы для современного бытия. Вот они -таки имеются, будь уверен. Хотя официально - вроде как и их нет. Да - неолибертианцы -доминируют на Западе, обладают значительной долей власти в России - вот и будем наблюдать переход к "социализации" в период Зимы -как и в каких деталях будет происходить сей нелегкий, но забавный процесс.

«История — это не то, что было. Это то, что может быть, потому что уже было однажды...» Тойнби

Карма: +2,222.01

Регистрация: 29.10.2009

Сообщений: 4,716

Читатели: 101

Регистрация: 29.10.2009

Сообщений: 4,716

Читатели: 101

Цитата: Sir Max Merfie от 15.01.2021 11:58:37Это они в связи с чем? Производство запустили, или пока только планы рисуют?

Тут есть существенные непонятки -суть которых в том, что неизвестен тот, кто производит скандия больше всех. По одним данным -США, по другим -РФ. 3 тонны - для этого элемента очень существенно, однако утверждалось, что США уже имеет общее производство около 100 тонн. Кто врет? - не известно, мы или они. Тема -стремная и ловко врать могут обе стороны, однако -вполне очевидно, что технологическая гонка в этом направлении-идет.

«История — это не то, что было. Это то, что может быть, потому что уже было однажды...» Тойнби

Гуанчжоу

Карма: +2,478.66

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

Цитата: бульдозер от 16.01.2021 07:21:36Тут есть существенные непонятки -суть которых в том, что неизвестен тот, кто производит скандия больше всех. По одним данным -США, по другим -РФ. 3 тонны - для этого элемента очень существенно, однако утверждалось, что США уже имеет общее производство около 100 тонн. Кто врет? - не известно, мы или они. Тема -стремная и ловко врать могут обе стороны, однако -вполне очевидно, что технологическая гонка в этом направлении-идет.

https://www.marketsa…st-to-2025

ЦитатаThe global Scandium Metal market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 11.5%% in the forecast period of 2020 to 2025 and will expected to reach USD 113.9 million by 2025, from USD 74 million in 2019.

Рынок скандия вырастет до 114 млн долларов к 2025 году.

В отчете вроде все цифры есть. Как я понял, его даже бесплатно можно получить, но он мне не нужен.

У китайцев читал, что в 2018 году запустили производство на базе MCC в Хэбэе. Первая очередь - 20 тонн в год, планировали расширяться.

Основные участники рынка:

ЦитатаThe major players covered in Scandium Metal are: Rusal, MCC, Platina Resources Ltd., Stanford Materials Corp., Sumitomo Metal Mining (SMM), Metallica Minerals, Hunan Oriental Scandium Co. Ltd., DNI Metals Inc., Scandium International Mining Corp., CODOS, Huizhou Top Metal Materials Co., Ltd (TOPM), Rongjiayu Technology, etc. Among other players domestic and global, Scandium Metal market share data is available for global, North America, Europe, Asia, Middle East and Africa and South America separately. Our analysts understand competitive strengths and provide competitive analysis for each competitor separately.

На сколько вижу, кроме MCC, там еще несколько китайцев. Более подробную информацию искать нет времени.

Отредактировано: Antiglobalist - 16 янв 2021 08:15:06

Карма: +8,672.47

Регистрация: 27.02.2020

Сообщений: 5,714

Читатели: 22

Регистрация: 27.02.2020

Сообщений: 5,714

Читатели: 22

Цитата: DeC от 16.01.2021 01:50:05В Сети появился меморандум, согласно которому администрация Обамы сознательно разрешила финансирование террористической группировки Аль-Каида.

ЦитатаЛюбой, кто, будучи должен быть верен Соединенным Штатам, начинает войну против них или присоединяется к их врагам, оказывая им помощь и утешение в пределах Соединенных Штатов или где-либо еще, виновен в измене и должен быть приговорен к смерти или будет заключен в тюрьму на срок не менее пяти лет и оштрафован по этому праву на сумму не менее 10 000 долларов США; и не может занимать какую-либо должность в Соединенных Штатах.

Раздел 18 Кодекса США, параграф 2381 - Измена

Вот это реально светило бы Обаме и его подручным, если б у Трампа были яйца...

Отредактировано: Новый Читатель - 16 янв 2021 08:44:14

"Россия беспощадна" (с) Жозеп Боррель

Лукка

77 лет

Карма: +30,281.74

Регистрация: 10.07.2007

Сообщений: 35,276

Читатели: 80

Регистрация: 10.07.2007

Сообщений: 35,276

Читатели: 80

Цитата: бульдозер от 16.01.2021 07:21:36Тут есть существенные непонятки -суть которых в том, что неизвестен тот, кто производит скандия больше всех. По одним данным -США, по другим -РФ. 3 тонны - для этого элемента очень существенно, однако утверждалось, что США уже имеет общее производство около 100 тонн. Кто врет? - не известно, мы или они. Тема -стремная и ловко врать могут обе стороны, однако -вполне очевидно, что технологическая гонка в этом направлении-идет.

Прилагаю сводку Геологического управления США за январь 2020. На полный перевод нет времени.

Главное открытие: собственное производство оксида скандия в США отсутствует как класс. Проекты есть.

Еще один пунктик: скандия в земной коре больше, чем свинца. Но он рассеян.

И еще пунктик: активно развиваются технологии замены скандия в приложениях или алюминием, или титаном.

SCANDIUM

In the United States, a feasibility study was completed on the polymetallic Elk Creek project in Nebraska. Probable

reserves were estimated to be 36 million tons containing 65.7 parts per million (2,400 tons) of scandium. Plans for the

project included downstream production of ferroniobium, titanium dioxide, and scandium oxide. The Bokan project in

Alaska and the Round Top project in Texas also included scandium recovery in their process plans. In addition,

Federal and State agencies were funding the development of methods to separate scandium from coal and coal

byproducts.

Globally, several projects were under development while seeking permitting, project financing, and offtake

agreements. Reserves at the Nyngan project in New South Wales, Australia, were estimated to be 1.4 million tons

containing about 590 tons of scandium. The developer expected to begin commissioning 38.5 tons per year of

scandium oxide production capacity in 2021. A definitive feasibility study on the polymetallic Owendale Project in New

South Wales was completed in 2018 with the potential to produce 20 tons per year of scandium oxide from reserves

of 4.0 million tons containing 570 parts per million scandium (3,500 tons of scandium oxide equivalent). Engineering

and design plans for the polymetallic Sunrise Project in New South Wales, continued to advance following an offtake

agreement for nickel and cobalt in 2019 and the completion of a definitive feasibility study in 2018. Proven and

probable reserves for the Sunrise Project were 147 million tons containing 53 parts per million (7,800 t) scandium. In

Queensland, following the completion of a bankable feasibility study on the polymetallic SCONI project in 2018,

reserves were updated to 57 million tons containing 35 parts per million (2,000 tons) scandium.

In the Philippines, a plant designed to recover 7.5 tons per year of scandium oxide equivalent began commercial

production at the Taganito high-pressure acid-leach nickel operation. An intermediate scandium concentrate was

exported to Japan.

In Russia, feasibility studies for making scandium oxide as a byproduct of alumina refining in the Ural Mountains were

ongoing. The pilot plant was reported to have produced scandium oxide with purity greater than 99%. Based on pilot

test results, plans were in place for a 3-ton-per-year scandium oxide plant. In Dalur, Kurgan region, development of

scandium recovery as a byproduct of uranium production continued, and production capacity included scandium

oxide (570 kilograms per year) and aluminum-scandium alloy (24.5 tons per year).

In the European Union, recovery methods were being developed to produce scandium compounds and aluminumscandium

alloys from byproducts of aluminum and titanium mining and processing. Globally, several projects were

underway to commercialize new aluminum-scandium alloys for casting and additive manufacturing.

World Mine Production and Reserves:6

No scandium was recovered from mining operations in the United States.

As a result of its low concentration, scandium is produced exclusively as a byproduct during processing of various

ores or recovered from previously processed tailings or residues. In recent years, scandium was produced as

byproduct material in China (iron ore, rare earths, titanium, and zirconium), Kazakhstan (uranium), Philippines

(nickel), Russia (apatite and uranium), and Ukraine (uranium). Foreign mine production data for 2019 were not

available.

World Resources:

Resources of scandium are abundant. Scandium’s crustal abundance is greater than that of lead.

Scandium lacks affinity for the common ore-forming anions; therefore, it is widely dispersed in the lithosphere and

forms solid solutions with low concentrations in more than 100 minerals. Scandium resources have been identified in

Australia, Canada, China, Kazakhstan, Madagascar, Norway, the Philippines, Russia, Ukraine, and the United States.

Substitutes:

Titanium and aluminum high-strength alloys, as well as carbon-fiber materials, may substitute in highperformance

scandium-alloy applications. Light-emitting diodes displace mercury-vapor high-intensity lights in some

industrial and residential applications. In some applications that rely on scandium’s unique properties, substitution is

not possible

Отредактировано: Dobryаk - 16 янв 2021 09:25:26

Вси бо вы сынове Божии есте верою о Христе Иисусе. Елице бо во Христа крeстистеся, во Христа облекостеся, несть иудей, ни эллин, несть раб ни свободь, несть мужеский пол, ни женский. Вси бо вы едино есте о Христе Иисусе

Послание Галатам Павла апостола

Послание Галатам Павла апостола

Сейчас на ветке:

356,

Модераторов: 0,

Пользователей: 52,

Гостей: 241,

Ботов: 63

1900.113

, Aaron

, AbbatFaria

, AlekseevIr

, Alexandr1974

, AwardRus

, BETEP1

, Baha_Bah

, Cmapuk

, Dimit

, Foxhound

, Glav407

, Green mamont

, MAPKOBKA

, Mixandr68

, Moksha

, Moriak2

, Resident1

, Rаgtime

, SaLut

, Starij

, Yuriy58

, Zu

, Zzerg

, _Raven_

, alex bert

, bmv58

, coshmar

, didgik

, hundert1970

, lakol

, margo81

, prof

, rat1111

, releyman

, saadam

, sdfyns

, talina

, vvmiten

, А75

, Алсар

, Андрей1980

, Братишка

, В. Вилежаня

, Валерий Васильевич

, Деймон Блэкфайр

, Помор 64

, Сорокин Борис

, Старушка с Урала

, Шланг

, неКони