Большой передел мира

265,046,846

519,618

Россия

Карма: +27,314.53

Регистрация: 08.11.2011

Сообщений: 16,325

Читатели: 5

Регистрация: 08.11.2011

Сообщений: 16,325

Читатели: 5

В Японии заявили, что не меняют позиции по Курилам в связи с поправкой к Конституции РФ

Новость 1.570 10

Правительство Японии не комментирует голосование по внесению изменений в Конституцию РФ, однако его базовая позиция по вопросу южных Курильских островов и заключения мирного договора остается прежней. Об этом в четверг на регулярной пресс-конференции заявил генеральный секретарь кабинета министров Японии Ёсихидэ Суга.Новость 1.570 10

"Мы внимательно следим за происходящим в российской внутренней и внешней политике, однако как правительство мы это (внесение поправки в Конституцию - прим. ТАСС) не комментируем. В нашей позиции, которая заключается в том, чтобы продолжать плотные переговоры, направленные на решение территориального вопроса с последующим подписанием мирного договора, изменений нет".

https://tass.ru/mezh…ma/8866085

Япошкам и всем прочим, кто имеют территориальные предъявы, лучше о них забыть.

Отредактировано: _Valera_ - 02 июл 2020 07:53:42

Массовая миграция чужих этносов в Россию и замещение ими государствообразующего русского народа является наибольшей угрозой национальной безопасности. В связи с этим, необходимо кардинальное изменение миграционной политики государства.

67 лет

Карма: +33,857.97

Регистрация: 04.12.2011

Сообщений: 10,620

Читатели: 23

Регистрация: 04.12.2011

Сообщений: 10,620

Читатели: 23

Цитата: DeC от 01.07.2020 13:41:58В Праге по случаю окончания карантина прямо на Карловом мосту накрыли стол длиной в 515 метров

Уже имеется весьма чёткое классическое определение происходящему: пир во время чумы.

Гимн Чуме (© Александр Сергеевич)

В Швейцарии заболеваемость Ковидом попёрла вверх. Абсолютные цифры пока небольшие, но вчера уже было больше сотни заболевших... Здравствуй, вторая волна! Со следующего понедельника ношение маски в общественных местах становится обязательным. Рановато народ расслабился.

Отредактировано: mn01 - 02 июл 2020 17:19:09

Можно подвести лошадь к воде, но нельзя заставить ее напиться

Москва

46 лет

Карма: +8,805.52

Регистрация: 30.05.2010

Сообщений: 14,696

Читатели: 9

Регистрация: 30.05.2010

Сообщений: 14,696

Читатели: 9

Советники президента США Дональда Трампа стали реже оповещать его о "связанных с Россией угрозах для США", сообщает телеканал CNN со ссылкой на бывших официальных лиц из администрации Трампа.

Согласно заявлениям многих бывших официальных лиц из администрации, которые присутствовали на посвященных разведке брифингах и готовили для них документы, противодействие Трампа предупреждениям разведки о России привело к тому, что команда президента по национальной безопасности стала реже информировать его о "связанных с Россией угрозах".

"Президент создал такую среду, которая отговаривает, если даже не запрещает, упоминать какую-либо разведывательную информацию, которая неблагоприятна для России", — приводит телеканал слова одного из бывших высокопоставленных сотрудников, занимавшихся вопросом национальной безопасности США.

Ранее газета New York Times со ссылкой на анонимных представителей американской разведки опубликовала статью, в которой утверждалось, что военная разведка РФ предлагала вознаграждение связанным с талибами боевикам за нападения на американских солдат в Афганистане и что президента США Дональда Трампа проинформировали об этом. Доказательств предоставлено не было.

Посольство РФ в США потребовало от властей страны адекватной реакции на угрозы, которые поступают в адрес дипломатов из-за новостей про Россию и Афганистан. МИД РФ назвал сообщения СМИ фейком. Трамп назвал статью "заказухой". Белый дом, Пентагон и разведка США заявили, что подтверждений сообщениям на данный момент нет и что Трампа о них не информировали.

Пресс-секретарь президента РФ Дмитрий Песков, комментируя публикацию New York Times про "сговор" России с талибами, заявил, что эти утверждения являются ложью. На вопрос журналистов о том, обсуждал ли Трамп каким-то образом эту тему с Владимиром Путиным в течение этого года, Песков ответил отрицательно.

.

Далее: https://news.rambler…e=copylink

.

Ну вот, перехват рулей начался.

Черная зависть к чужим успехам, злоупотребление властью и бюрократизм - это непростая проблема, связанная с характером или стилем работы этого форума, а вопрос идеологический.(с)

Я диванный стратег 92 уровня.

Я диванный стратег 92 уровня.

24 года

Карма: +2,263.19

Регистрация: 15.10.2012

Сообщений: 5,695

Читатели: 0

Регистрация: 15.10.2012

Сообщений: 5,695

Читатели: 0

Цитата: _Valera_ от 02.07.2020 07:52:47Правительство Японии не комментирует голосование по внесению изменений в Конституцию РФ, однако его базовая позиция по вопросу южных Курильских островов и заключения мирного договора остается прежней. Об этом в четверг на регулярной пресс-конференции заявил генеральный секретарь кабинета министров Японии Ёсихидэ Суга.

"Мы внимательно следим за происходящим в российской внутренней и внешней политике, однако как правительство мы это (внесение поправки в Конституцию - прим. ТАСС) не комментируем. В нашей позиции, которая заключается в том, чтобы продолжать плотные переговоры, направленные на решение территориального вопроса с последующим подписанием мирного договора, изменений нет".

https://tass.ru/mezh…ma/8866085

Япошкам и всем прочим, кто имеют территориальные предъявы, лучше о них забыть.

ну пусть не меняют - территориальные претензии обоюдоострый инструмент

в какой то момент мы можем на этой основе выкатить встречные претензии

если понадобится

Sonora-Саратов-Кировоград

Карма: +5,447.49

Регистрация: 17.08.2007

Сообщений: 5,070

Читатели: 17

Регистрация: 17.08.2007

Сообщений: 5,070

Читатели: 17

Цитата: black_rnb от 02.07.2020 07:38:06Вот я никак не пойму с этими зонами, а чего сложного отключить свет, воду, газ и т.п. ; жратву и остальное не давать (выйти с поднятыми руками можешь, зайти обратно - нет) и свободная зона будет совершенно свободна от людей через неделю, максимум две. Или этому мешает толерастность, демокретинизм и прочие голоса в голове?

Вы можете смеяться, но отключать коммунальные услуги во многох штатах ЗАПРЕЩЕНО законом!

В реале всё происходит так.

Если домовладелец перестал оплачивать, скажем, электричество, то включается процедура: электрическая компания ОБЯЗАНА насобирать задолженность домовладельца за три месяца минимум (т.е. иными словами, подождать три месяца - а то вдруг он заплатит?), и только потом (внимание!) передать дело в местный "Отдел сбора налогов за недвижимость" (есть такой в каждом графстве или городе), и этот отдел присовокупит задолженность к ежегодному налогу, который в свою очередь уплчивается два раза в год - в апреле и декабре. (Плюс штрафы за посрочку сначала прибл 10%).

Если домовладелец при очередной уплате налога на недвижимость (в апреле или декабре) погашает всю задолженность - данное дело прекращается. (Т.е. назавтра он снова может затеять волынку).

Если домовладелец не оплачивает налог на недвижимость, то графство передаёт дело о взыскании в суд.

Судебное разбирательство может занять несколько месяцев - в зависимости от обстоятельств.

В самом крайнем случае неуплаты, задолженность обращается на недвижимость, т.е. недвижимость продаётся с молотка. На всё это могут уйти годы (но и злостный неплательщик теряет очень сильно).

При всём при этом неплательщик может "внезапно" взять и погасить задолженность практически в любой моент времени (с причитающимися штрафами всем вовлеченным гос-органам).

+++++++++++++++++++++++++++

Я лично подозреваю (хотя и не знаю точно), что "освободившиеся народные массы" в "зоне свободы" дружно прекратили оплачивать коммуналку. Свобода ведь!

И тут им стали приходить письма от компаний с разъяснениями, что будет дальше (см. выше). Плюс с рекомендацией обзавестись адвокатом по будущему делу.

А Америку в "зоне свободы" ведь никто не отменял; да и сами протестующие как бы не против электро-, газо- и водоснабжения.

Но перспектива замаячила весьма отчётливая. Потребил - плати! И не отвертеться.

Тут-то "зона свободы" и сдулась с воззванием от вожаков расходиться по домам. Т.е. отчасти коммуналка сработала в деле подавления мятежа - просто в виде наступления суровой необходимости коммуналку оплачивать.

А полиция просто пришла порядок навести.

Отредактировано: Хроноскопист - 02 июл 2020 13:16:37

"In Dollar We Trust".

"The best way to predict the future is to create it."

Economy is a strict master. Экономика - строгий хозяин.

"При создании данного контента не пострадало ни одно животное".

"The best way to predict the future is to create it."

Economy is a strict master. Экономика - строгий хозяин.

"При создании данного контента не пострадало ни одно животное".

Гуанчжоу

Карма: +2,478.66

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

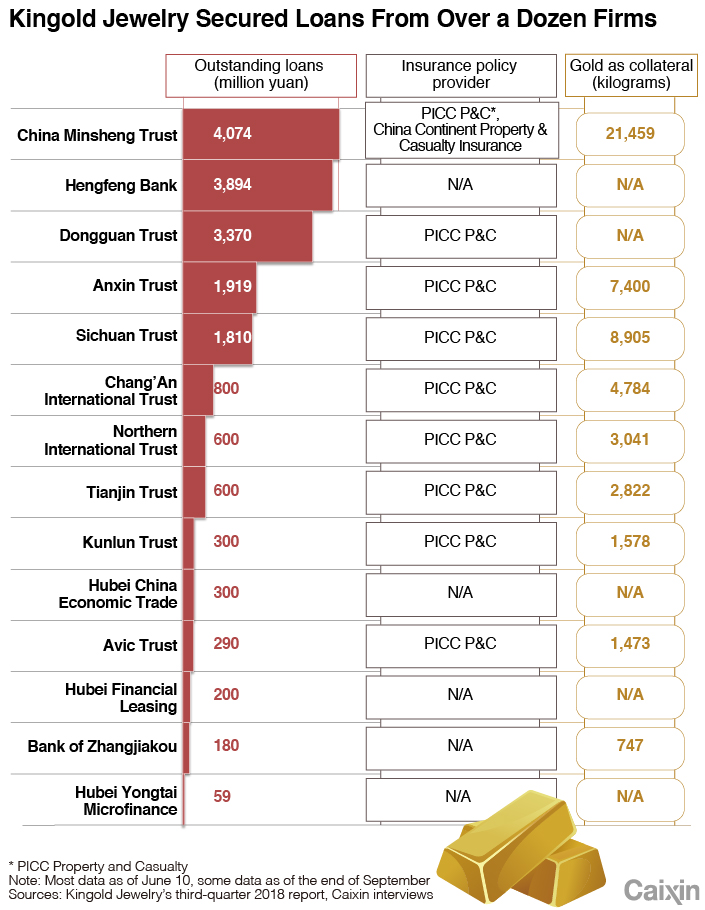

Цитата: Фракталь от 02.07.2020 07:24:49ИА Цайсин

Исследование, проведённое китайским новостным агентством Caixin, показало, что крупнейший частный переработчик золота в провинции Хубэй в центральном Китае Wuhan Kingold Jewelry использовал как минимум 83 тонны поддельного золота в качестве залога для займов на сумму 20 млрд юаней ($ 2,8 млрд) от более десятка китайских финансовых учреждений.

Сообщается, что фальшивое обеспечение эквивалентно 22% годового производства золота в Китае и 4,2% государственного золотого запаса по состоянию на 2019 год. Другими словами, более четырёх процентов официальных золотых запасов Китая могут быть поддельными.

Поддельный металл был обнаружен в феврале, когда один из кредиторов Kingold Dongguan Trust решил ликвидировать своё обеспечение для покрытия долгов. После их заявления три других кредитора Kingold провели тесты золота в своих хранилищах и обнаружили, что оно также было не настоящим.

Kingold был основан в 2002 году Цзя Чжихуном, который когда-то управлял золотыми приисками, принадлежащими Народной освободительной армии. Kingold начинался как золотодобывающая фабрика, связанная с Народным банком Китая, но в дальнейшем во время реструктуризации организация отмежевалась от центрального банка. По состоянию на сентябрь 2019 года активы компании равнялись $ 3,3 млрд, её акции котируются на фондовой бирже Nasdaq.

Это не первый случай, когда в Китае поддельное золото используется в качестве залога. В 2016 году регуляторы обнаружили золотые слитки с черным вольфрамом в центре, предоставив кредиты в размере 19 млрд юаней ($ 2,5 млрд).

очень интересный подкоп под Китай.

Для начала. Чтобы понятнее было.

Первое. Caixin - агентство, которое любит заниматься журналистскими расследованиями. Очень много у них скандальных расследований в отношении беглых китайских олигархов, которые не хотят возвращаться в Китай из США. Очень громкое было в отношении Го Вэньгуя. Погуглите. Т.е. часто журналисты издания пинают тех, кого нужно отпинать.

Во-вторых. Не знаю, кто вам переводил статью из Caixin, но в ней чуть по другому все описано.

Я дам весь текст статьи на английском под спойлером, при желании ознакомьтесь:

ЦитатаСкрытый текст

Итак, в издании в оригинале:

as at least some of 83 tons of gold bars used as loan collateral turned out to be nothing but gilded copper.

Т.е. по крайней мере некоторые из золотых слитков, общее количество которых 83 тонны, оказались позолоченной медью. А у вас написано, что как минимум 83 тонны фальшивого золота было. Согласитесь это, мягко говоря, не одно и то же.

ЦитатаДо сих пор неясно, был ли залог фальсифицирован в самом начале или замена произошла позднее. Источники из Minsheng Trust и Dongguan Trust подтвердили, что слитки проверялись сторонними тестирующими организациями и строго контролировалось представителями Kingold, кредиторами и страховщиками в процессе доставки.

Издание задается вопросом: кто знал про фальсификации золота. Был ли это сговор заемщика и кредитора, заемщика и страховщиков или может все были в курсе про фальсификации, а потом что-то пошло не так. Директора Хубейского отделения страховой компании вместе со всей командой уже уволили, но говорят, что по другому поводу.

Проблемы у Kingold начались, когда они захотели выкупить у государства производителя автозапчастей Tri-Ring. Своих средств у Kingold не хватало, причем очень не хватало и они решили привлечь кредиты под залог золота. Вобщем, заплатили 7 млрд. юаней, а получили одних земельных участков, принадлежащих Tri-Ring на 40 млрд.

Третье, откуда у вас сделан вывод, что Другими словами, более четырёх процентов официальных золотых запасов Китая могут быть поддельными.

Это каким боком? Т.е. Kingold обеспечение своих кредитов из официальных золотых запасов Китая делал?

НУ, и четвертое. Регуляторы в 2016 году зафиксировали позолоченные вольфрамовые слитки, но регуляторы не предоставляли кредиты, кредиты предоставляли кредиторы. И когда один из кредиторов попытался расплавить слиток, то внутри его обнаружился вольфрам. Это было крупнейшее в Китае дело о мошенничестве с золотом.

Вобщем, думаю, тут простой передел собственности. Без далеко идущих последствий. Может еще владелец Kingold кому дорогу перешел или берега потерял и его на землю возвращают.

Карма: +2,879.02

Регистрация: 28.10.2008

Сообщений: 8,587

Читатели: 4

Регистрация: 28.10.2008

Сообщений: 8,587

Читатели: 4

ЦитатаМосква, 1 июл - ИА Neftegaz.RU. Компания Газпром экспорт перечислила польской PGNiG денежные средства по решению суда о пересмотре цен на газ для Польши, однако будет и дальше обжаловать это решение.

Об этом сообщили в Газпром экспорте.Скрытый текст

...

upd

ЦитатаВАРШАВА, 1 июля. /ТАСС/. Польская энергетическая компания PGNiG вернет "Газпрому" $90 млн, так как российская сторона выплатила слишком большую компенсацию без учета недоплат. Об этом заявил в среду на брифинге глава PGNiG Ежи Квечиньский.

Пока по очкам газпромовские юристы не выигрывают, а совсем даже наоборот. Посмотрим, чем закончится.

Отредактировано: Vladislav - 02 июл 2020 10:13:02

тэт а сэ щий гине

Уфа

49 лет

Карма: +766.77

Регистрация: 12.08.2009

Сообщений: 2,346

Читатели: 0

Регистрация: 12.08.2009

Сообщений: 2,346

Читатели: 0

Цитата: dmitriк62 от 01.07.2020 11:47:02На какой же из банкнот будет эта чёрная будка, Флойд? на стольнике?

На двадцатке, конечно же, именно ее со своим портретом он и пытался сбыть )))

Кстати, должна быть еще одна опция - любая двадцатидолларовая купюра не должна считаться фальшивой )))

Карма: +7,241.42

Регистрация: 11.01.2009

Сообщений: 13,518

Читатели: 4

Регистрация: 11.01.2009

Сообщений: 13,518

Читатели: 4

Цитата: Himic3 от 01.07.2020 13:26:04НА самом деле ситуация тяжёлая, как сняли карантин начался итальянский сценарий. БОльницы переполнены, пациентов не принимают, очередь из карет скорой помощи у ворот инфекционок, в которых умирают пациенты не дождавшись помощи. Особенно тяжело на юге. Картина страшная, едешь и во всех аптеках очереди стоят, в процедурных кабинетах тоже очереди. Парацетамола не найти. ТЕстов тоже нет, в поликлинике говорят болейте дома, реактивов нет в лабораториях, никуда не ходите, если только будет тяжело дышать, вызывайте скорую. Так что официальной статистике верить нельзя. Заболевших на порядок больше.

Кого не спроси все болеют, я тоже переболел тяжело, до сих пор странные ощущения в грудной клетке. Сегодня получил результат анализа на антитела - отрицательный. Каждый день новости что кто то умер с пневмонией.

Самое интересно это то, что по официальной статистике резкий всплеск пневмоний - в 7,1 раз, делают ПЦР тест, на антитела, а они отрицательные.

По долгу своей службы вижу все вызовы на скорую, средне около 2 тыс звонков, с 27 мая начался рост и 23 июня всплеск до 20 тыс, потом чуть упало 10 11 16 тыс, вот вчера 23 тыс рекорд по городу зафиксировал.

Чиновники поголовно на больничные уходят, работать некому, президент сказал что его поручения по борьбе с КВИ провалены, выговоры всем сделал. Назначен новый министр здравоохранения (Кореец). Это он на первой встрече сказал что ситуация плохая, нужно помощи просить у соседей.

Конечно здорово, что РФ помогает.

Вот только кому?

Если на просьбу о помощи будет выставлен простые требования- помогать можно только тем, кто действует толково, и по этому переводите свое законодательство в рамках здравоохранения под эгиду минздрава РФ.

То есть , не просто мы дали, а у вас как получилось, а толково.

Отменяется система сертификация лекарств в КЗ, становиться она российской. Приняли протокол новый лечения в РФ- автоматически доводят его до всех врачей в КЗ...

Меняются принципы организации мед помощи с соровских на российские.

Всех соросят из системы в КЗ гнать.....

Вот тогда эффективность такой помощи будет выше.

Надо думать о рациональности помощи. и требовать.

А не только мы обосрались- помогите...

Хорошо- но исправляйте где наделали...

и ещё 2 обязательных условия.

Освещение во всех СМИ в положительном ключе такую помощь. и регулярно, минимум 2 раза в неделю. по тв каждый день каждый канал. на казахско языке в 2 раза больше чем на русском.

и второе, садить в тюрьму всех против такой помощи, как вредителей здоровья казахстанцев.

В реальности в КЗ ни где сми это не освещают. нет события.

Отредактировано: Alex_new - 02 июл 2020 10:54:32

главная проблема всех нациков- ответственность за сказанное. Они ее очень не любят. Брать берут. Нести- нет.

Санкт-Петербург

24 года

Карма: +20,157.99

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

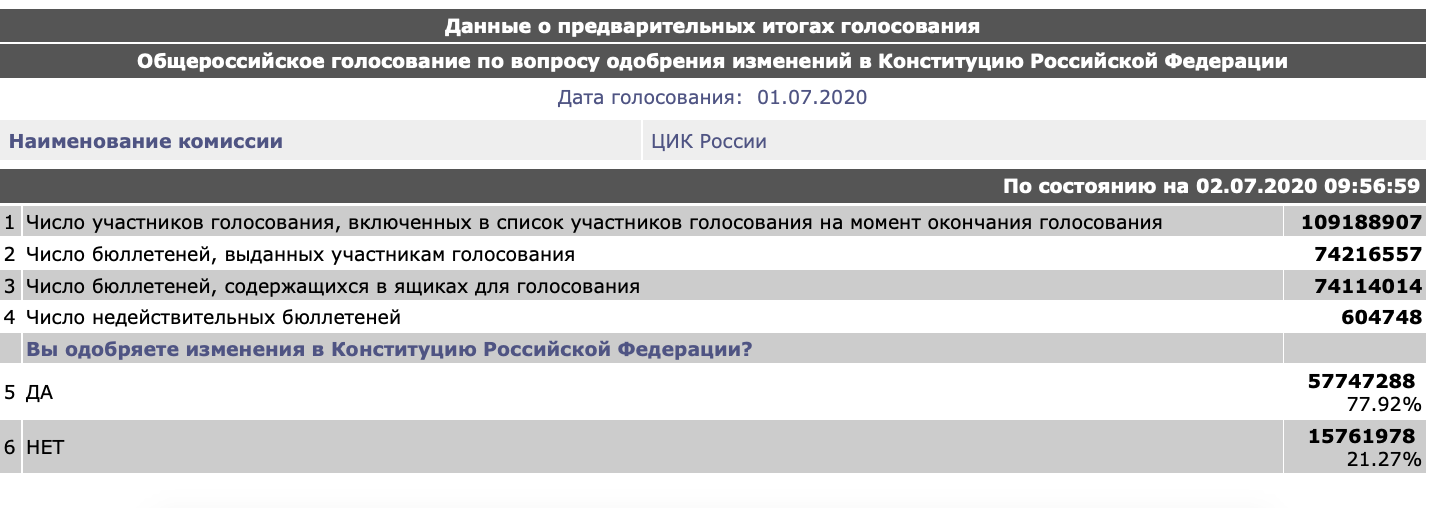

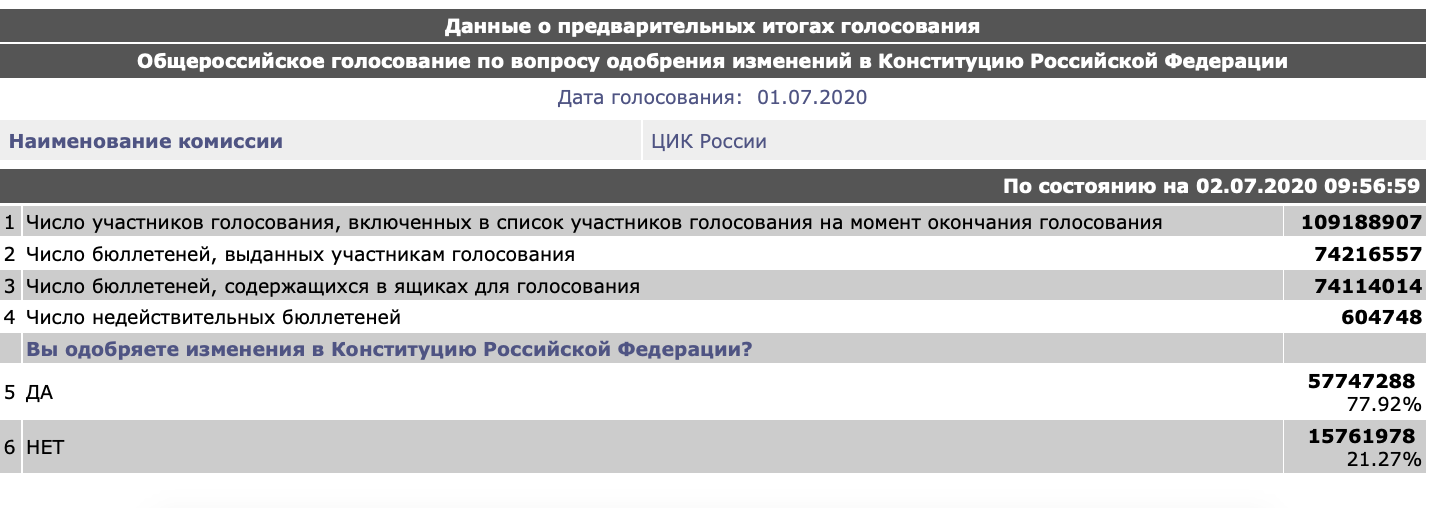

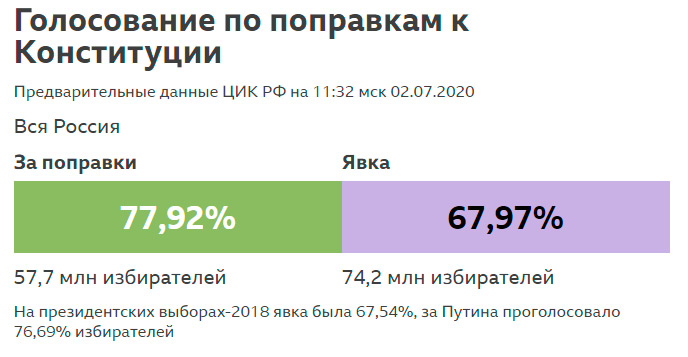

Окончательная явка составила 67,97% от общего числа имеющих право голоса.

Итого, ЗА поправки прогосовали 52,89% от общего числа граждан, имеющих право голоса (включая тех, кто не участвовал в голосовании)

Отредактировано: NavyGator - 01 янв 1970

Мы летим вперед, а глядим назад.

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Карма: +4,880.54

Регистрация: 14.05.2010

Сообщений: 17,819

Читатели: 7

Регистрация: 14.05.2010

Сообщений: 17,819

Читатели: 7

Цитата: black_rnb от 02.07.2020 07:38:06Вот я никак не пойму с этими зонами, а чего сложного отключить свет, воду, газ и т.п. ; жратву и остальное не давать (выйти с поднятыми руками можешь, зайти обратно - нет) и свободная зона будет совершенно свободна от людей через неделю, максимум две. Или этому мешает толерастность, демокретинизм и прочие голоса в голове?

В Сиэттле ОЧЕНЬ много нег.. ээ.. африканцев. В основном - бомжи и мелкий криминал. Народ неприхотливый, мост над головой есть, и годно. На полицию исторически плюют, полиция на них - тоже. Поэтому, обе стороны удивлены тем, что теперь приходится "общаться".

Дисциплина важна, чтобы добиться успеха, но одной дисциплины недостаточно. Нужна внутренняя мотивация для достижения цели. И конечно, трудолюбие. Это талант заставить себя работать и уметь это делать продуктивно. (ВВП)

Санкт-Петербург

24 года

Карма: +678.78

Регистрация: 25.12.2012

Сообщений: 2,664

Читатели: 0

Регистрация: 25.12.2012

Сообщений: 2,664

Читатели: 0

Цитата: DeC от 01.07.2020 23:56:461 июля 2020

Россия поразила экономических обозревателей со всего мира неординарным валютным маневром в отношении госдолга США. Статья соответствующего содержания появилась на страницах издания Sohu.Скрытый текст

Авторы публикации утверждают, что это было нестандартное решение Кремля, который поступил, опираясь на холодный расчет. Геополитическая ситуация, как и экономическая, постоянно меняется, и у России получается учитывать данные обстоятельства. Москва может полностью отказаться от использования доллара США, поскольку он слишком часто является финансовым и политическим инструментом. При этом для золота наступил идеальный момент. Если Россия продаст часть своих запасов на одном из пиков стоимости драгметалла, то хорошо на этом заработает, а после продолжит инвестировать в золото.

Источник

Вотпрос только за что продать золото. Ну не за доллары же. Взамен нужно что то вещественное как и золото а не нолики в компах.

Санкт-Петербург

24 года

Карма: +20,157.99

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

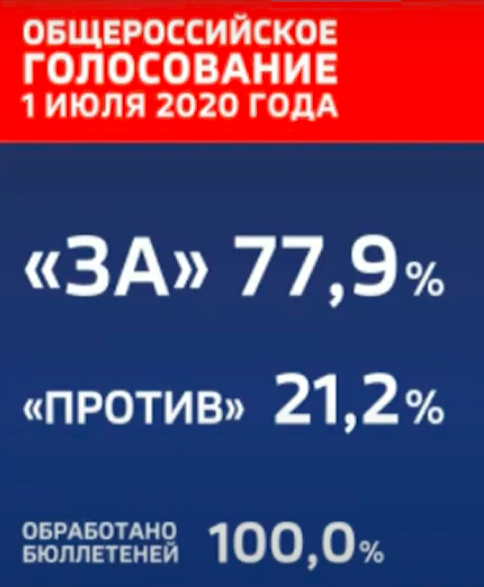

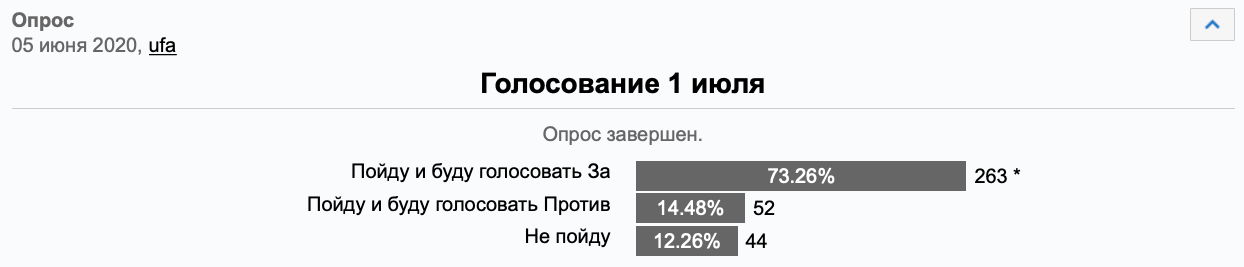

Авантюра, как всегда показала блестящее попадание с прогнозом результатов голосования. У нас на форуме ЗА поправки проголосовали 83,5% от тех, кто пришёл бы на выборы. Реальный результат - 77,9%. Ошибка 5,6% - вполне приемлемая для социологических служб.

Отредактировано: NavyGator - 01 янв 1970

Мы летим вперед, а глядим назад.

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Смоленщина

40 лет

Карма: +2,034.20

Регистрация: 25.05.2020

Сообщений: 1,732

Читатели: 3

Регистрация: 25.05.2020

Сообщений: 1,732

Читатели: 3

Саудовская Аравия пригрозила разжечь ценовую войну на нефтяном рынке, если члены соглашения ОПЕК+ не компенсируют объемы сокращений по добыче, обязательства по которым они не выполнили ранее - WSJ

Судя по тому, что происходит в мире — слово «Совесть», его смысл и значение, существуют только на русском языке!

Санкт-Петербург

24 года

Карма: +20,157.99

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

Регистрация: 07.01.2009

Сообщений: 19,469

Читатели: 20

Везде пишут про явку 65% на голосовании по поправкам в Конституцию. Это неверная информация. 64,99% - это данные на 18.00 1 июля по явке.

Вот правильные данные:

Приняли участие в голосовании 74216557 избирателей из 109188907 человек, внесённых в списки для голосования, то есть не 64,99%, а 67,97%, то есть больше 2/3 от числа списочного состава избирателей

Вот правильные данные:

Приняли участие в голосовании 74216557 избирателей из 109188907 человек, внесённых в списки для голосования, то есть не 64,99%, а 67,97%, то есть больше 2/3 от числа списочного состава избирателей

Отредактировано: NavyGator - 01 янв 1970

Мы летим вперед, а глядим назад.

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Какой раньше рай! Какой раньше ад!

Мой родной народ, оглянись вперед!

Андрей Вознесенский, 1981

Санкт-Петербург

46 лет

Карма: +490.43

Регистрация: 08.02.2012

Сообщений: 470

Читатели: 1

Регистрация: 08.02.2012

Сообщений: 470

Читатели: 1

Цитата: sturmvogel_ru от 02.07.2020 08:25:14ппц

Не меняют они позиции...

Голодные коты у моего подъезда, которым я ничего не даю. тоже не меняют позиции. Продолжают клянчить.

Разве от этого им что-то перепадёт?

Ну котов понять можно. А вдруг вы заведете новую женщину, которая любит котиков, аж спать не может, и она начнет вам выносить мозг про покормить "бедных, несчастных, голодных котиков, ну тебе жалко что ли, вон еды полно, давай кинем им косточку, у тебя еды девать некуда, мы сами столько не съедим, давай покормим...". И вот вы для того, чтобы заткнуть этот фонтан, кидаете первую подачку: "Да нате, подавитесь"...И это станет началом конца. Поэтому и клянчут.

"Только редко высказывающиеся люди умеют произносить такие убийственные в своей простоте фразы."

"Как только ты начинаешь что-то понимать, первая твоя реакция — вытряхнуть из себя это понимание."(с) Мириам

"Как только ты начинаешь что-то понимать, первая твоя реакция — вытряхнуть из себя это понимание."(с) Мириам

Гуанчжоу

Карма: +2,478.66

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

Регистрация: 20.04.2009

Сообщений: 3,003

Читатели: 9

Генеральным секретарем Совета национальной безопасности Особого административного района Гонконг сегодня назначен Чэнь Гоцзи (Eric Chan Kwok-ki, 陳國基). Практически вся его карьера прошла в Иммиграционном департаменте Гонконга, куда он пришел в 1982 году помощником Офицера и дослужился к 2011 году до Директора департамента иммиграции. С 2017 года он возглавлял Канцелярию Главы администрации Гонконга Кэрри Лэм.

Сам товарищ гонконгский, но бакалавра права получал в Университете Цунхуа. Это лучший китайский ВУЗ, расположен в Пекине. Теперь будет за безопасность в Гонконге отвечать.

Также сегодня назначили нового начальника Департамента иммиграции. Им стал Цю Цзяхун (Ou Jiahong), пришедший в департамент помощником Офицера в 1988 году и сейчас возглавивший ведомство.

Ну, и еще одна новость сегодня для гонконгцев:

Правительство проинформировало о состоянии проекта, предусматривающего выдачу гражданам по 10 000 гонконгских долларов (около 1200 американских долларов). Сообщается, что на получение помощи уже зарегистрировалось примерно 5,42 млн гонконгцев.

Получить помощь смогут постоянные жители Гонконга в возрасте старше 18 лет.

Правительство Гонконга запустило план выдачи наличных в размере 10 000 гонконгских долларов и начало принимать заявки 21 июня. Хотя акция продлится до конца следующего года, многие люди хотели бы побыстрее получить деньги. Финансовый секретарь Гонконга Чэнь Маобо заявил, что если граждане зарегистрировались в электронном виде в банке в течение первых 10 дней с начала действия плана, с 21 по 31 июня, то на банковский счет деньги для них поступят после 8 июля.

По последним данным (по состоянию на 18:00 30 июня) всего за 10 дней 5,42 миллиона жителей Гонконга (70%) подали заявки на получение субсидии, из которых почти 4,62 миллиона жителей Гонконга (60%) сделали это через электронную банковскую регистрацию заявки на получение денег.

Сам товарищ гонконгский, но бакалавра права получал в Университете Цунхуа. Это лучший китайский ВУЗ, расположен в Пекине. Теперь будет за безопасность в Гонконге отвечать.

Скрытый текст

Скрытый текст

Правительство проинформировало о состоянии проекта, предусматривающего выдачу гражданам по 10 000 гонконгских долларов (около 1200 американских долларов). Сообщается, что на получение помощи уже зарегистрировалось примерно 5,42 млн гонконгцев.

Получить помощь смогут постоянные жители Гонконга в возрасте старше 18 лет.

Правительство Гонконга запустило план выдачи наличных в размере 10 000 гонконгских долларов и начало принимать заявки 21 июня. Хотя акция продлится до конца следующего года, многие люди хотели бы побыстрее получить деньги. Финансовый секретарь Гонконга Чэнь Маобо заявил, что если граждане зарегистрировались в электронном виде в банке в течение первых 10 дней с начала действия плана, с 21 по 31 июня, то на банковский счет деньги для них поступят после 8 июля.

По последним данным (по состоянию на 18:00 30 июня) всего за 10 дней 5,42 миллиона жителей Гонконга (70%) подали заявки на получение субсидии, из которых почти 4,62 миллиона жителей Гонконга (60%) сделали это через электронную банковскую регистрацию заявки на получение денег.

Москва

Карма: +9,466.96

Регистрация: 20.06.2020

Сообщений: 9,162

Читатели: 27

Регистрация: 20.06.2020

Сообщений: 9,162

Читатели: 27

Цитата: NavyGator от 02.07.2020 11:52:31Везде пишут про явку 65% на голосовании по поправкам в Конституцию. Это неверная информация. 64,99% - это данные на 18.00 1 июля по явке.

Вот правильные данные:Скрытый текст

Приняли участие в голосовании 74216557 избирателей из 109188907 человек, внесённых в списки для голосования, то есть не 64,99%, а 67,97%, то есть больше 2/3 от числа списочного состава избирателей

Тоже заметил эту ошибку у многих СМИ.

Не везде, кстати, пишут неправильно. Например, на bbc изначально писали правильную явку:

https://www.bbc.com/russian/news-53238574

________________________________________________________________

Президентские выборы в России 2012:

Явка - 65,34 %

За Путина - 63,60 %

Президентские выборы в России 2018:

Явка - 67,54 %

За Путина - 76,69 %

Голосование по поправкам к Конституции 2020:

Явка - 67,97 %

За (Путина) - 77,92 %

Нынешнюю большую явку и большой процент ЗА можно расценивать в том числе и как общенародное выражение доверия Владимиру Путину. Его популярность в стране только выросла за последние годы.

Отредактировано: User78 - 02 июл 2020 12:16:32

50 лет

Карма: +2,732.48

Регистрация: 03.08.2016

Сообщений: 1,939

Читатели: 1

Регистрация: 03.08.2016

Сообщений: 1,939

Читатели: 1

ПЕКИН, 2 июл – РИА Новости. Китай как стратегический партнер и дружественный сосед РФ уважает выбранный российским народом путь развития страны, заявил на брифинге в четверг официальный представитель МИД КНР Чжао Лицзянь, комментируя прошедшее голосование по поправкам в Конституцию РФ.

"Мы обратили внимание, что общероссийское голосование по поправкам в Конституцию РФ, которое стало важным политическим событием в России, прошло спокойно. Результаты, обнародованные Центральной избирательной комиссией РФ, отражают выбор российского народа", - заявил дипломат.

По его словам, как дружественный сосед и стратегический партнер России "Китай всегда будет уважать путь развития, независимо выбранный российским народом, а также поддерживать усилия РФ в осуществлении долгосрочной стабильности и продвижении социально-экономического развития".

"Мы готовы работать с российской стороной на основании достигнутого нашими лидерами консенсуса, углублять взаимодействие и взаимовыгодное сотрудничество, чтобы принести еще больше выгод народам наших стран", - добавил он.

Согласно представленным в информцентре ЦИК данным после обработки 100% протоколов, за принятие поправок в Конституцию РФ проголосовали 77,92% россиян, против - 21,27%.

"Мы обратили внимание, что общероссийское голосование по поправкам в Конституцию РФ, которое стало важным политическим событием в России, прошло спокойно. Результаты, обнародованные Центральной избирательной комиссией РФ, отражают выбор российского народа", - заявил дипломат.

По его словам, как дружественный сосед и стратегический партнер России "Китай всегда будет уважать путь развития, независимо выбранный российским народом, а также поддерживать усилия РФ в осуществлении долгосрочной стабильности и продвижении социально-экономического развития".

"Мы готовы работать с российской стороной на основании достигнутого нашими лидерами консенсуса, углублять взаимодействие и взаимовыгодное сотрудничество, чтобы принести еще больше выгод народам наших стран", - добавил он.

Согласно представленным в информцентре ЦИК данным после обработки 100% протоколов, за принятие поправок в Конституцию РФ проголосовали 77,92% россиян, против - 21,27%.

50 лет

Карма: +2,732.48

Регистрация: 03.08.2016

Сообщений: 1,939

Читатели: 1

Регистрация: 03.08.2016

Сообщений: 1,939

Читатели: 1

ЯЛТА, 2 июл – РИА Новости. Международные эксперты положительно оценили процесс голосования в Крыму по поправкам в конституцию РФ, заявив, что он прошел согласно всем демократическим стандартам и своей атмосферой напоминал праздник.

Делегация европейских политиков и экспертов находится в Крыму с рабочим визитом. В ее состав вошли девять человек, в том числе пять французских депутатов Европейского парламента.

"То, что спрашивают мнение народа относительно своего будущего и фундаментального закона страны, это очень важно. Это то, что должно происходить в каждой стране мира. В целом у меня осталось очень положительное впечатление о всем процессе голосования", - сказал журналистам депутат Европарламента, член комитета по иностранным делам, президент ассоциации "Франко-российский диалог" Тьерри Мариани.

Вице-председатель политической партии "Альтернатива болгарского возрождения" Любомира Ганчева подчеркнула, что голосование было организовано на высоком уровне. "Все было по золотому стандарту проведения выборов. Мне очень понравилась высокая активность крымчан. Очень важно, что крымчане проявили свой гражданский долг", - заявила Ганчева.

Депутат парламента Берлина Гуннар Линдеманн отметил, что у немцев, в отличие от граждан России, нет возможности голосовать и изменять свою конституцию, так как эти полномочия находятся в руках депутатов бундестага. "Очень важно, что люди вовлечены в демократические процессы. Весь процесс голосования прошел по европейским демократическим стандартам", - сказал Линдеманн.

Журналист, бывший депутат парламента Швеции Эрик Альмквист подчеркнул, что процесс голосования был демократичным, особенно его поразила организация. "Посещая избирательные участки в Москве и Санкт-Петербурге, мы видели, что люди туда шли выполнять свой долг, в Крыму же процесс голосования был сродни празднику", - заявил Альмквист.

Поправки в конституцию РФ в Крыму поддержали 90,07% избирателей, принявших участие в голосовании, против высказались 9,08%. Явка составила 81,75%.

Делегация европейских политиков и экспертов находится в Крыму с рабочим визитом. В ее состав вошли девять человек, в том числе пять французских депутатов Европейского парламента.

"То, что спрашивают мнение народа относительно своего будущего и фундаментального закона страны, это очень важно. Это то, что должно происходить в каждой стране мира. В целом у меня осталось очень положительное впечатление о всем процессе голосования", - сказал журналистам депутат Европарламента, член комитета по иностранным делам, президент ассоциации "Франко-российский диалог" Тьерри Мариани.

Вице-председатель политической партии "Альтернатива болгарского возрождения" Любомира Ганчева подчеркнула, что голосование было организовано на высоком уровне. "Все было по золотому стандарту проведения выборов. Мне очень понравилась высокая активность крымчан. Очень важно, что крымчане проявили свой гражданский долг", - заявила Ганчева.

Депутат парламента Берлина Гуннар Линдеманн отметил, что у немцев, в отличие от граждан России, нет возможности голосовать и изменять свою конституцию, так как эти полномочия находятся в руках депутатов бундестага. "Очень важно, что люди вовлечены в демократические процессы. Весь процесс голосования прошел по европейским демократическим стандартам", - сказал Линдеманн.

Журналист, бывший депутат парламента Швеции Эрик Альмквист подчеркнул, что процесс голосования был демократичным, особенно его поразила организация. "Посещая избирательные участки в Москве и Санкт-Петербурге, мы видели, что люди туда шли выполнять свой долг, в Крыму же процесс голосования был сродни празднику", - заявил Альмквист.

Поправки в конституцию РФ в Крыму поддержали 90,07% избирателей, принявших участие в голосовании, против высказались 9,08%. Явка составила 81,75%.

Отредактировано: Из тех, которые с Урала. - 02 июл 2020 12:20:12

Сейчас на ветке:

403,

Модераторов: 1,

Пользователей: 66,

Гостей: 290,

Ботов: 46

-Echo-

, Alexey K_9eb97d

, Avant

, BUR

, Domino_Designer

, Efrussell

, FROGRAmm

, Feral ArtRaz

, GD

, GTesla

, Max V

, NRJ

, Ol@

, R6790

, Rustik 666

, Sinbad

, Slant

, Udav

, VVK

, Vadim_65

, Vesper

, Wat

, Yuri957

, _Aqua_

, _taras_

, alb@tros

, alex_okt

, amv3d

, askandrew

, avgust

, avr

, belskif

, bmv58

, edl

, frogi

, horrordash

, ivrom

, mich

, svoroponov

, ups

, v_56

, waik

, xion

, Алёша Попович

, Андрей_Котов

, Вадик 69

, Гриша.

, ДмитрийА

, Дончанка

, ИРС

, Ктулх Оглы

, Мастер Фикс

, Металург

, НАлЕ

, Поверонов

, Призрак шоссе

, Серафим13

, Сизиф

, Суринамо

, Терешко

, Технарь_

, Швейк

, воффка1

, дон Чунита

, солянка